TV Is Dying, And Here Are The Stats From The US That Prove It

The TV business is having its worst year ever.

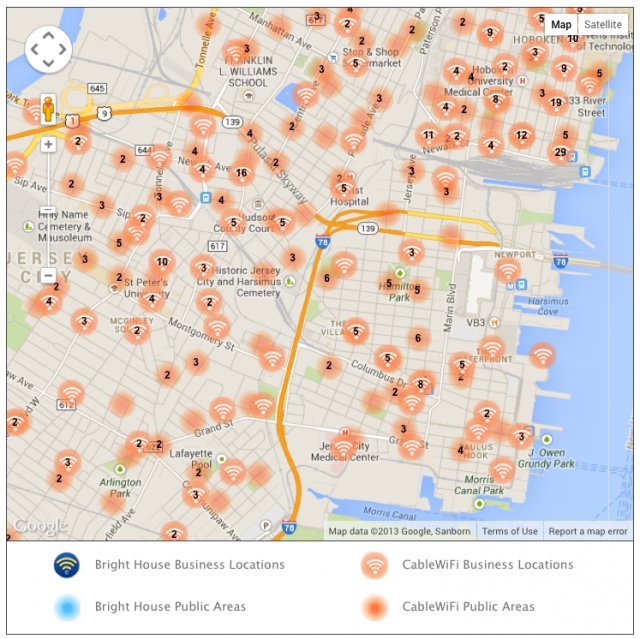

Audience ratings have collapsed: Aside from a brief respite during the Olympics, there has been only negative ratings growth on broadcast and cable TV since September 2011, according to Citi Research.

Media stock analysts Craig Moffett and Michael Nathanson recently noted, “The pay-TV industry has reported its worst 12-month stretch ever.”

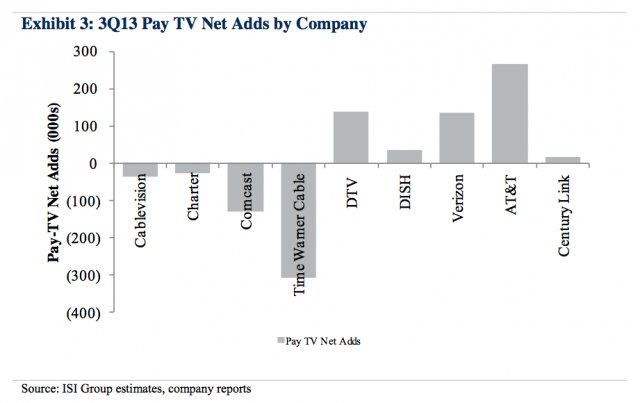

All the major TV providers lost a collective 113,000 subscribers in Q3 2013. That doesn’t sound like a huge deal — but it includes internet subscribers, too.

Broadband internet was supposed to benefit from the end of cable TV, but it hasn’t.

In all, about 5 million people ended their cable and broadband subs between the beginning of 2010 and the end of this year.

People are unplugging.

Time Warner Cable, for instance, lost 306,000 TV subscribers in Q3, and 24,000 broadband web subscribers, too.

And Tom Rutledge, CEO of Charter Communications, told Wall Street analysts he was “surprised” that 1.3 million of his 5.5 million customers don’t want TV — just broadband internet. “Our broadband-only growth has been greater than I thought it would be,” he said.

The following charts show the evidence that cable TV is dying, and that people are also unplugging from broadband internet service.

Cable TV ratings are sinking.

Cable TV ratings are in an historic slump. Note that the “growth” line, as charted by Citi analysts Jason B. Bazinet and Joshua P. Carlson, is persistently below zero.

Citi Research

Click to enlarge.

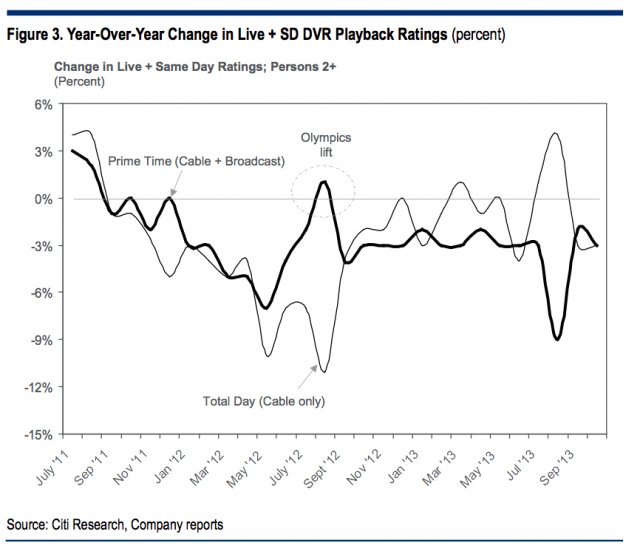

Click to enlarge.Fewer people are watching TV.

This is the macro problem: Ratings are falling across the board. They have been for years.

It’s not too surprising that broadcast TV ratings are down. The major networks have faced increasing competition for years from niche-interest cable channels and the better-quality programming on places like AMC and HBO.

But ratings for both cable and the broadcast networks are down.

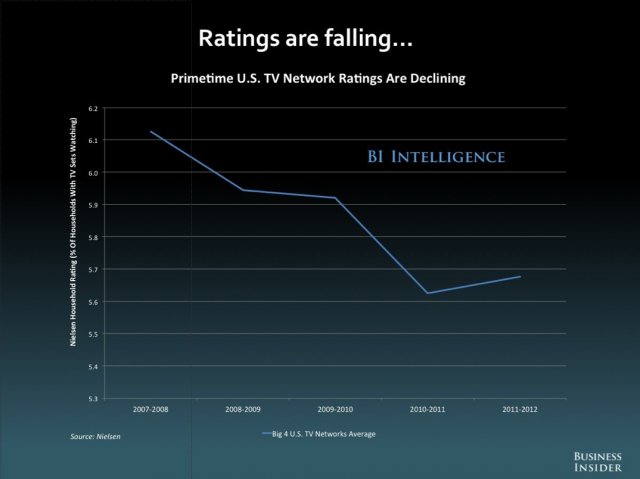

Even ratings for some major TV events are in decline.

People just don’t watch the World Series like they used to. Recently, viewer decline is led by young people, according to Business Insider’s Sports Page:

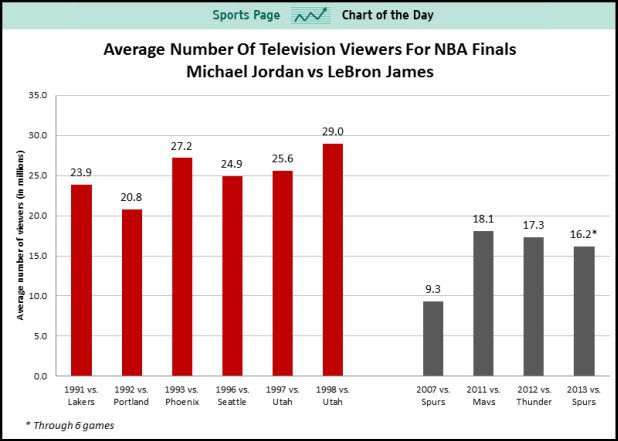

It’s the same with basketball.

Maybe people prefer the NBA to the MLB? Turns out that today’s big stars don’t grab TV eyeballs the way they used to either.

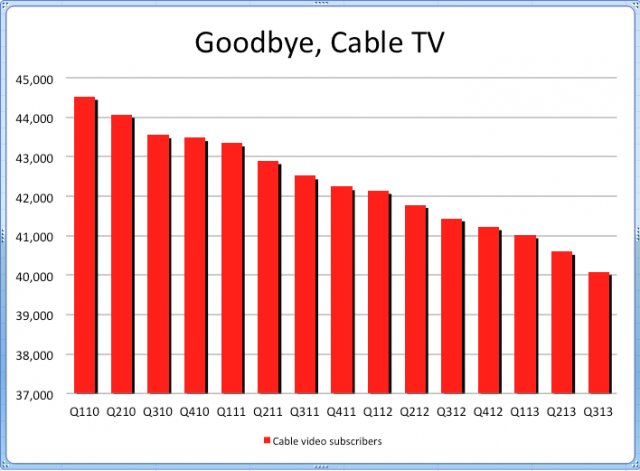

For the first time ever, the number of cable TV subscribers at major providers is about to dip below 40 million.

Click to enlarge.

Click to enlarge.So why are ratings in decline?

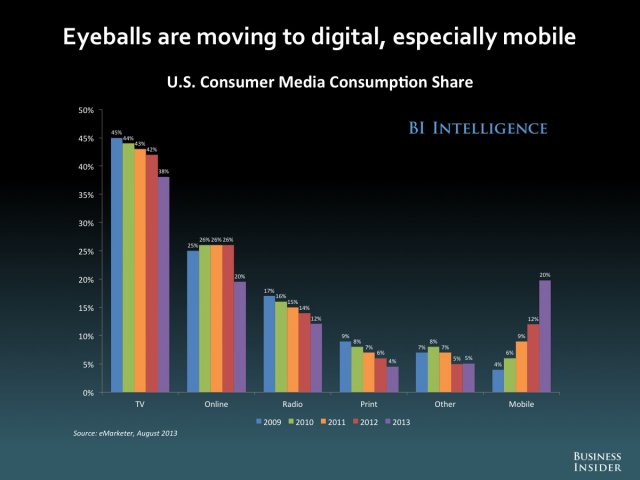

We’re at the beginning of a major historical shift from watching TV to watching video — including TV shows and movies — on the internet or on mobile devices.

This is going to hurt cable TV providers.

Nearly 5 million cable TV subscribers have gone elsewhere in the last five years. The number of subscribers remaining could sink below 40 million later this year, according to this data from ISI Group, an equity research firm (at right).

Cable and broadband companies are increasingly unable to retain customers.

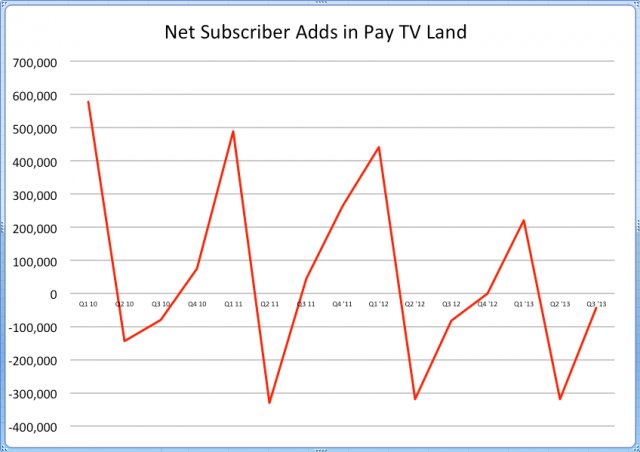

This chart (below) is the most important chart in this set: It shows the number of net subscriber additions across all types of customers — cable TV, broadband internet and landline phone.

The cable and broadband subscriber business is seasonal. The net number of people leaving or adding services changes with the seasons, because people like to move house in the fall.

It used to be that up to 500,000 new subscriptions would be added across all companies in any given quarter. But now, cable and internet companies are lucky if they get any new subscribers at all. Increasingly, the industry loses subscribers rather than gaining them, according to thisdata from One Touch Intelligence:

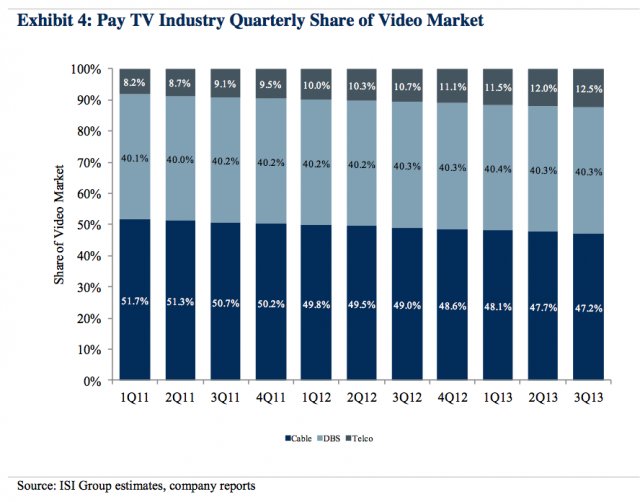

For the first time ever, less than half of subscribers at the major broadband companies now subscribe to cable TV.

What’s happening is that people are giving up on cable TV as a standalone product, and the market is shifting in favour of telco companies like AT&T and Verizon who offer TV as a package with high-speed internet access, according to media equity analysts at ISI Group. (Direct Broadcast Satellite appears to be remaining steady, in part because its customers often live in more rural areas and have fewer alternatives.)

Here is how individual TV providers are affected.

It’s not an across-the-board collapse. But this is what you would expect to see during a technological sea-change: The weaker players are crumbling. The stronger players are picking up some of the pieces … but how long can they also resist the tide?

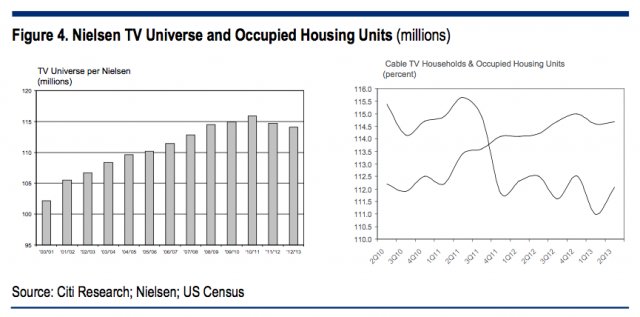

Fewer households actually have TV.

One macro-economic factor behind the decline is that fewer houses actually have TV.

These charts, from Citi Research, show that the total “Nielsen TV Universe” — the number of people who watch TV — is declining. Note that the number of U.S. households is still growing, but growth in the number of households with cable TV is declining.

Fewer households have TV because they are watching video on mobile devices instead.

Here’s the big picture: People are spending more of their time on mobile, and less of their time on TV:

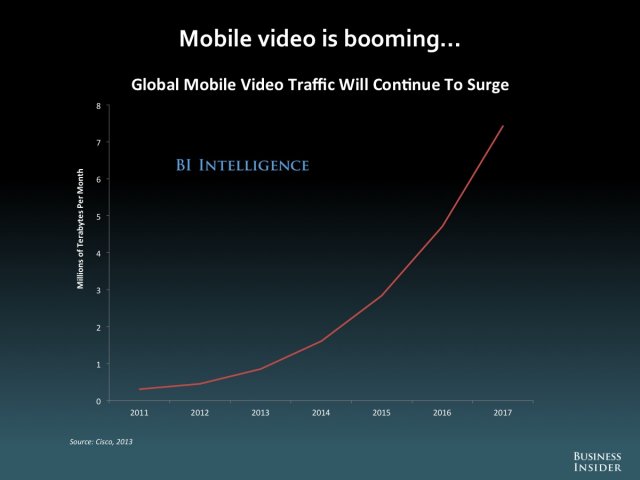

Mobile video is booming.

Even though iPhone and Android phones still struggle to show video seamlessly, the amount of video seen on mobile devices is going through the roof. About 40% of all YouTube traffic comes from mobile.

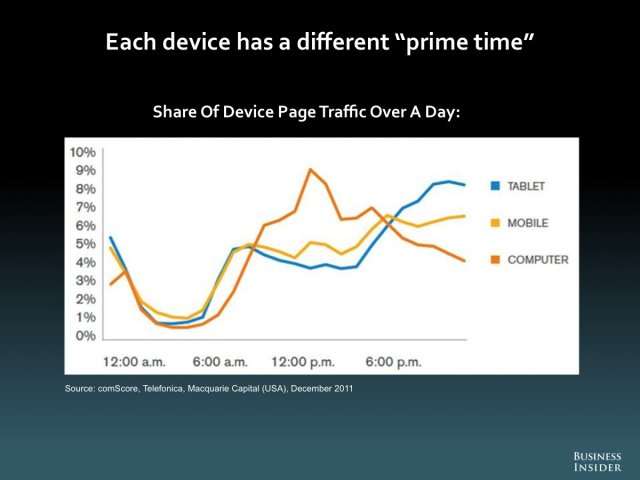

Tablets are stealing prime time, the period we used to devote to TV.

In the media industry, iPads and other tablets are sometimes called “vampire” media — they come out at night.

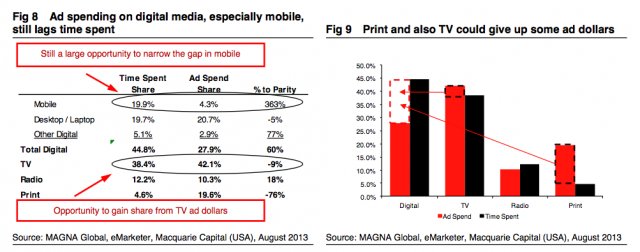

Slowly, the money is following the eyeballs. It is shifting from TV to digital media of all kinds.

This research from Macquarie Capital shows a giant mismatch between where people spend their time and where advertising money is spent. People spend more time with digital media than TV now. Ad dollars are likely to follow that shift in the long run, Macquarie says.

Macquarie Capital

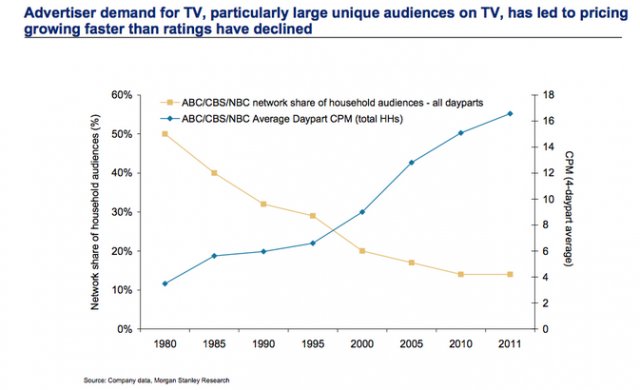

Ad revenue increases are masking the macro decline of TV.

The collapse of TV is having a counter-intuitive effect on TV ad sales: prices are going up, even though the number of commercials is going down.

The reason? It’s still really, really difficult to gather a large, mass audience in any kind of media, mobile or otherwise. The Super Bowl — on TV — is the only media property than can reach more than 100 million people in a three-hour stretch. That scarcity of large audiences makes TV’s dwindling-but-still-big audience increasingly valuable.

The TV business may actually be addicted to the very thing that is killing it.

Even though cable TV has had its worst year ever, cable TV revenues are still rising because companies are charging the dwindling number of customers more in subscription fees. According to analysts Craig Moffett and Michael Nathanson, those higher prices are “part of the problem” that pushes out poor subscribers — losing the TV business even more eyeballs:

“Of course, the fact that pay-TV revenue is still rising smartly is part of the problem … We have always argued that cord-cutting is an economic phenomenon, not a technological one. … Pay-TV revenue growth reflects rapid pay-TV pricing growth and that is precisely the problem. Rapidly rising prices are squeezing lower-income consumers out of the ecosystem.”

The market does not care that the TV audience is declining.

This chart (below) shows a basket of cable TV stocks over the last year. Not bad!

Time Warner Cable CEO Glenn Britt said in his last-ever conference call that the cable business has been ‘in denial.’

Britt, who is retiring because he has been diagnosed with cancer, told analysts on his Q3 2013 earnings call that he thought the cable business had spent too many years complacently dismissing the competition:

Regarding competition, well, duh, we have competition. I say that because when I first got this job 12 years ago, I think the cable industry as a whole, including our company, was in denial that we had real, viable competition. And I still hear some of my peers saying dismissive things about our competitors. And certainly, each of them has strengths and weaknesses, just as we do. However, they are around to stay, and we need to keep getting better at competing.

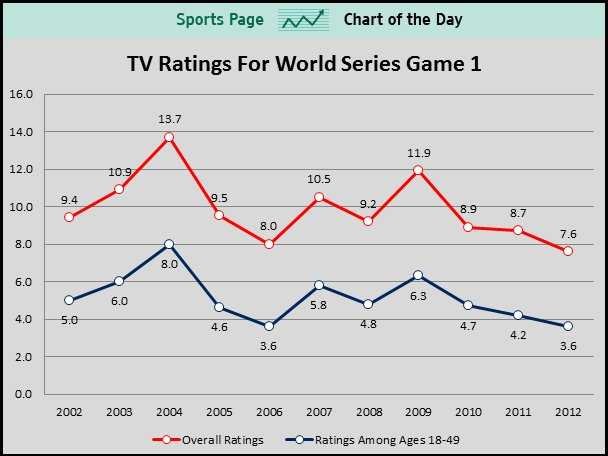

People who are unplugging from both cable TV and broadband internet are likely going to free wifi.

So if fewer people are watching cable TV and fewer people are paying for Internet service, does that mean that we just don’t care about watching our favourite shows anymore?

Not necessarily.

Free wifi — at work, in coffee shops, and on campuses — is making it easier for consumers to get the shows, movies and videos they want without subscribing to any kind of cable or broadband service

All of Starbucks offers free wifi, for instance.

50-seven cities in the U.S., including Los Angeles, offer free wifi. Facebook and Cisco have joined to offer free wifi access to customers in any business who check in to Facebook. Facebook’s original free wifi test included just 25 stores in the Bay Area. The company has now expanded it to 1,000.

For some people, there is just no need for a cable or pipe to deliver the internet or TV to their residence specifically, as long as they are within range of a free wifi hotspot.

This chart shows the free wifi hotspots available in Jersey City, N.J. Most reasonably dense areas of the U.S. look like this now, according to Bright House Networks, a company that tracks and maps wifi hotspots: