Selling Your Business in New Zealand: What You Need to Know

Selling a business is a significant milestone that requires careful planning and expertise. Engaging an experienced business advisor can streamline the process, optimize outcomes, and reduce stress. Here’s how working with an advisor can guide you through the sale:

- Initial Preparation: Setting the Foundation

- Business Assessment: An advisor evaluates your business’s readiness for sale, considering factors such as profitability, market positioning, and operational efficiency.

- Valuation Services: They calculate your business’s fair market value by analysing key metrics like cash flow, assets, and industry-specific benchmarks.

- Documentation Review: Advisors ensure your financial records, contracts, and operational data are accurate and up-to-date, a critical step to attract serious buyers.

- Strategic Planning for the Sale

- Customized Strategies: Advisors tailor a sales plan aligned with your goals, whether they include maximizing value, achieving a swift sale, or ensuring legacy preservation.

- Buyer Profiling: Using their industry knowledge and networks, they identify and qualify potential buyers, ensuring alignment with your objectives.

- Confidential Marketing and Buyer Outreach

- Professional Information Memorandum (IM): Advisors craft a compelling and confidential business profile, presenting your business to prospective buyers without risking sensitive information.

- Selective Marketing: They market your business discreetly through targeted channels, including their network of investors, other businesses, and high-net-worth individuals.

- Managing Due Diligence and Buyer Interactions

- Coordinating the Process: Advisors facilitate due diligence, helping buyers verify your financial and operational claims while protecting your business’s confidentiality.

- Intermediary Role: They act as a buffer during discussions, ensuring negotiations remain professional and productive.

- Deal Structuring and Negotiation

- Negotiation Expertise: Advisors handle discussions around pricing, payment structures, warranties, and contingencies, ensuring a favourable outcome.

- Optimized Structuring: They collaborate with legal and financial experts to design a deal structure that minimizes risks and aligns with your long-term financial goals.

- Closing and Handover

- Final Documentation: Advisors ensure all agreements, including sale and purchase agreements, are accurate and legally binding.

- Smooth Transition: They help facilitate the handover process, including staff communication, client continuity, and post-sale obligations.

Why Use an Advisor?

- Expert Guidance: Experienced advisors bring insights into market trends, buyer behaviour, and valuation methods, maximizing the sale’s success.

- Time Efficiency: With advisors handling the process, you can focus on maintaining your business’s performance.

- Enhanced Value: Advisors often secure higher sale prices through strategic marketing and skilful negotiation.

Partnering with a trusted advisor can transform a complex business sale into a seamless, profitable experience. By leveraging their expertise and connections, you can achieve the best possible outcome, ensuring a smooth transition and securing your financial future.

Understanding Market Appraisals vs. Business Valuations for Mid-Market Business Owners in New Zealand

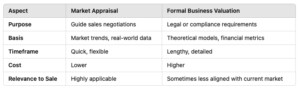

As a business owner, determining the true value of your company is one of the most critical steps when planning for a sale, merger, or investment. However, it’s essential to understand the distinction between a market appraisal and a formal business valuation to make informed decisions in today’s mid-market environment.

Market Appraisals vs. Business Valuations: What’s the Difference?

Market Appraisal

A market appraisal estimates what your business is likely to sell for in the current market. It uses real-world data such as:

- Comparable sales within your industry.

- Current buyer demand and economic conditions.

- Qualitative factors like reputation or customer relationships.

Market appraisals provide a practical and actionable guide to set realistic expectations and prepare for negotiations.

Formal Business Valuation

On the other hand, a business valuation involves detailed theoretical analysis, such as:

- Historical financial statements.

- Projected cash flows and asset valuations.

- Industry-standard valuation formulas, like EBITDA multiples.

These are often required for legal, tax, or compliance purposes but may not fully reflect what buyers are currently paying.

Why Market Appraisals Are Essential for Selling Your Business

Setting Realistic Price Expectations

Market appraisals help ground your expectations in reality. Many business owners tend to overestimate the value of their business due to emotional attachment. A data-driven market appraisal offers an objective perspective, ensuring pricing aligns with buyer demand.

Sale Preparation

A market appraisal identifies areas for improvement before going to market, such as:

- Cleaning up financial records.

- Optimizing operations.

- Highlighting growth opportunities.

This preparation can increase buyer interest and improve final sale prices.

Supporting Negotiations

A credible market appraisal is a powerful tool in negotiations. It provides a benchmark for discussions, helping to resolve pricing disputes and build buyer confidence.

How to Leverage Market Appraisals as a Business Owner

- Evaluate Sale Timing: Use an appraisal to understand market conditions and decide when to sell.

- Plan Strategically: Identify strengths and weaknesses in your business to enhance its appeal.

- Work with Experts: Collaborate with experienced brokers or M&A advisors for deeper insights and better outcomes.

Partnering with Experts for Accurate Market Appraisals

For mid-market businesses, specialised advisors like Three Sixty Capital Partners offer tailored appraisals grounded in the New Zealand market. Their expertise helps bridge the gap between market realities and seller expectations, ensuring you’re well-prepared for the M&A journey.

A market appraisal is an invaluable tool for understanding your business’s value in the current market and preparing for a successful sale. By combining this with professional advisory services, you can confidently navigate the complexities of mid-market transactions and achieve optimal results. For tailored guidance, consider connecting with experts who specialise in New Zealand’s business landscape.

Choosing an Accountant to Navigate M&A Transactions for Your Business Sale

If you’re a business owner considering selling your business in New Zealand, selecting the right accountant is crucial for a successful transaction. Accountants are more than just number crunchers—they are strategic advisors who can guide you through the complexities of preparing, marketing, and finalizing the sale of your business.

How Accountants Support M&A Transactions

- Preparation and Readiness

- Financial Clean-Up: Accountants help organize and refine your financial records, ensuring they present an accurate and attractive picture to potential buyers.

- Forecasting and Valuation: They develop detailed financial forecasts to demonstrate future growth potential and advise on business valuation methods that align with industry standards.

- Due Diligence Support

- Accuracy Checks: Accountants ensure your financial data can withstand scrutiny during buyer due diligence, which builds trust and accelerates the sale process.

- Tax Compliance: Managing tax obligations and structuring transactions to minimize tax liabilities is a key part of their role.

- Strategic Deal Structuring

- Evaluating Offers: Accountants provide insights into the implications of various deal structures, such as earn-outs or deferred payments, helping you weigh risks and rewards.

- Market Insights: They work alongside M&A advisors or brokers to align the financial aspects of the deal with market trends.

- Confidentiality and Timing

- Maintaining Discretion: A skilled accountant ensures sensitive financial information is only shared with vetted buyers, preserving confidentiality.

- Optimizing Timing: They help you focus on financial preparation rather than solely relying on market timing, ensuring your business is always sale-ready.

What to Look for in an Accountant for Business Sales

Expertise in M&A Transactions

Look for accountants with a proven track record in mid-market M&A, particularly those familiar with your industry.

Collaboration with Advisors

- Choose an accountant experienced in working with boutique investment banks or business brokers, such as Three Sixty Capital Partners who specialise in mid-market sales.

Strategic Communication

- An accountant who can clearly explain complex financial details and act as an intermediary between you and potential buyers is invaluable.

Partnering with M&A Specialists

- Accountants often collaborate with boutique investment banks or business brokers to provide comprehensive services for business owners. While the accountant focuses on financial clarity and tax optimisation, advisors like Three Sixty Capital Partners handle buyer identification, negotiation, and deal closure.

Why This Matters

- Selling your business is a once-in-a-lifetime decision for many owners. An accountant experienced in M&A can make the process seamless, secure better outcomes, and help you achieve your financial goals.

If you’re planning to sell, consult with a reputable accountant early to position your business for success.

Why You Need a Commercially Astute M&A Lawyer for Your Business Sale or Purchase

Buying or selling a business is one of the most significant financial milestones you’ll encounter. It’s a complex process that goes beyond financials, involving negotiations, legalities, and strategic decision-making. Amid this complexity, an experienced mergers and acquisitions (M&A) lawyer can be your most valuable partner—especially one who is commercially astute.

A commercially astute M&A lawyer doesn’t just focus on the legal details; they understand the broader business implications of every decision and bring a strategic mindset to the transaction. Here’s why their involvement is indispensable.

Turning Complex Agreements into Strategic Documents

Sale and Purchase Agreements (SPAs) are intricate legal documents filled with nuances that can have significant business implications.

A commercially astute M&A lawyer will:

- Go beyond boilerplate legal terms to craft agreements that align with your business goals.

- Proactively identify clauses that could affect the commercial viability of the deal, such as restrictive covenants or performance-based payments.

- Translate complex legal jargon into actionable insights, ensuring you fully understand the implications of each term.

Risk Mitigation with a Business Lens

Every business transaction comes with risks, but not all risks are created equal. A commercially savvy lawyer helps you prioritize and address risks that matter most to your business.

They’ll:

- Focus on risks that could affect valuation, post-deal integration, or operational continuity.

- Balance risk mitigation with deal feasibility, ensuring the transaction remains attractive to both parties.

- Recommend pragmatic solutions, such as insurance or phased payments, to bridge gaps in negotiations.

Sharper Negotiation Skills

Negotiating an M&A deal isn’t just about getting the best legal terms—it’s about understanding the commercial levers that drive value. A commercially astute M&A lawyer can:

- Leverage their knowledge of industry trends and market norms to strengthen your position.

- Help frame your arguments in a way that resonates with the other party’s business priorities.

- Advocate for terms that not only protect you legally but also enhance the deal’s commercial viability, such as favourable earn-outs or equity arrangements.

Regulatory Compliance with a Strategic Approach

While legal compliance is non-negotiable, a commercially astute lawyer looks at regulatory requirements through a business lens.

They’ll:

- Identify opportunities to streamline regulatory approvals or optimize deal structure for tax efficiency.

- Ensure compliance without overcomplicating or slowing down the process.

- Highlight potential regulatory hurdles early, allowing time for creative solutions.

Streamlining the Deal Process

Time is often of the essence in M&A transactions. A commercially minded lawyer works efficiently, ensuring the deal progresses smoothly without sacrificing critical oversight.

They’ll:

- Act as a coordinator among all parties, from accountants to bankers.

- Keep momentum alive by anticipating bottlenecks and addressing them proactively.

- Balance attention to detail with an ability to drive toward a timely close.

Delivering Value Beyond Legal Advice

What sets a commercially astute M&A lawyer apart is their ability to see the big picture. They’re not just focused on closing the deal—they’re invested in ensuring the transaction delivers long-term value for you.

This means:

- Advising on post-deal integration strategies and potential pitfalls.

- Evaluating how specific deal terms could impact operational or financial performance after the close.

- Acting as a trusted advisor who understands your broader business strategy.

An M&A transaction is more than just a legal exercise—it’s a transformative business decision. Partnering with a commercially astute M&A lawyer ensures you’re not just protected from risks but positioned to maximize the value of the deal.

They bring the perfect blend of legal expertise and business acumen, ensuring every decision supports your strategic objectives. When the stakes are this high, you need more than a lawyer—you need a partner who truly understands your business.

Navigating Bank Debt for M&A Transactions: Leveraging Debt for Strategic Growth

Securing bank debt for mergers and acquisitions (M&A) is a critical yet challenging aspect of deal-making. Debt plays a pivotal role in these transactions, enabling buyers to leverage their equity and amplify their purchasing power. However, the process of obtaining financing is often complex, requiring buyers to navigate a labyrinth of internal bank procedures. Identifying the right banking partner is crucial, as they can facilitate smoother negotiations and quicker approvals.

Debt financing offers several advantages in M&A deals. By supplementing equity with bank loans, buyers can achieve a higher return on investment, diversify risk, and preserve liquidity for other strategic initiatives. Yet, the process of accessing this capital often requires in-depth knowledge of banking systems and strong relationships with key decision-makers.

This is where an experienced M&A advisor becomes invaluable. Advisors not only bring a deep understanding of the financing landscape but also leverage their long-standing relationships with financial institutions. They can identify the right banking contacts, negotiate favourable terms, and streamline the process, ensuring transactions move forward efficiently.

Moreover, a skilled advisor understands the nuances of structuring debt in a way that aligns with the buyer’s financial strategy. From setting appropriate debt-to-equity ratios to negotiating repayment terms, their expertise helps mitigate risks while maximizing value.

For buyers looking to capitalize on growth opportunities through M&A, partnering with a seasoned advisor is not just helpful—it’s transformative. Their guidance ensures that financing complexities don’t impede strategic goals, allowing buyers to focus on creating long-term value from their acquisitions.

If you’re embarking on an M&A journey, consider engaging an advisor who can bridge the gap between you and the financial resources you need to succeed. With the right support, navigating bank debt becomes less of a hurdle and more of an enabler for growth.

Earn-Outs in Business Sales: A Strategic Tool for Bridging the Gap

Selling or buying a business often comes with differing views on valuation. Sellers may see untapped potential, while buyers focus on risks and historical performance. Enter the earn-out—a powerful tool to align expectations and bridge the valuation gap.

An earn-out is a deferred payment mechanism where part of the sale price is contingent on the business achieving specific performance targets post-sale. While earn-outs can unlock opportunities, they require careful structuring to ensure they benefit both parties.

How Earn-Outs Work

In an earn-out arrangement:

- The buyer pays a portion of the purchase price upfront.

- Additional payments are made if the business meets agreed-upon targets, such as revenue, profit, or customer retention, over a defined period.

- Terms, metrics, and timelines are outlined in the Sale and Purchase Agreement (SPA).

Benefits of Earn-Outs

- Aligning Valuation with Performance

Earn-outs reduce disagreements over valuation. Sellers can prove the business’s potential, while buyers limit upfront risk by tying additional payments to results. - Incentivizing Transition Success

When a seller remains involved post-sale, earn-outs motivate them to actively contribute to the business’s success during the transition period. - Expanding Deal Opportunities

Buyers with limited initial capital can use earn-outs to structure deals creatively, making acquisitions more accessible.

Challenges of Earn-Outs

- Disputes Over Performance Metrics

Clear, objective, and measurable metrics are essential. Ambiguities in how performance is calculated can lead to disputes. - Control Issues

Sellers may have concerns if the buyer’s post-sale decisions impact the ability to meet earn-out targets. - Complex Negotiations

Earn-outs require detailed discussions to align expectations and define terms. Without experienced advisors, this can become a sticking point.

Structuring a Successful Earn-Out

To maximize the effectiveness of an earn-out:

- Define Clear Metrics

Use measurable KPIs like EBITDA, revenue, or unit sales. Specify how they’ll be calculated and audited. - Set Realistic Targets

Ensure performance goals are achievable given the market, resources, and post-sale plans. - Establish Reasonable Timelines

Typically, earn-out periods range from 1 to 3 years. Align the timeline with the nature of the business and the industry cycle. - Address Control and Governance

Clarify the roles of buyers and sellers during the earn-out period. Include provisions to prevent decisions that could unfairly affect targets. - Seek Expert Guidance

Engage experienced M&A advisors and lawyers to draft agreements, mitigate risks, and ensure terms are enforceable.

Earn-outs are a versatile tool in business sales, offering flexibility and risk-sharing when buyers and sellers can’t agree on valuation. However, their success hinges on clear terms, realistic expectations, and mutual trust.

If you’re considering an earn-out in your next business sale or acquisition, ensure you have the right advisors to navigate the complexities and craft a deal that works for everyone.