New Zealand’s Investor Visas: Unlocking Opportunities in the Mid-Market

Introduction New Zealand has quietly, and now more actively, been reshaping its pathway for global investors. The government’s introduction of the Business Investor Visa, alongside the existing Active Investor Plus Visa, is designed to attract [...]

Partial Exits and Strategic Succession: A Better Way to Sell Your Business

Succession Isn’t a Switch You Flip: Why Every Business Owner Needs to Start the Exit Clock Early For many successful business owners, the idea of selling their company only becomes real when it has to—usually [...]

Holding the Line: NZ Business in a Shifting Global Landscape

As we move through 2025, New Zealand’s economic and business environment is being tested on multiple fronts. A high interest rate regime, lingering geopolitical tensions, and cautious global markets are creating a challenging backdrop for [...]

Richmond Foods Sale Completed

Three Sixty Capital Partners is pleased to confirm that the sale of Richmond Foods Limited has successfully settled. We acted as exclusive financial adviser to the vendor, guiding the transaction through to completion in early [...]

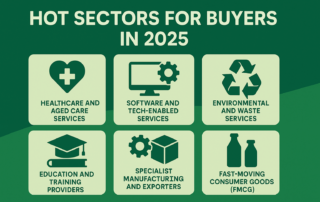

What Sectors Are Hot for Buyers in 2025 (and Why It Matters for Founders Thinking About Exit)

Not all industries are created equal, especially when it comes to M&A. While overall deal activity has remained steady, buyers in 2025 are more targeted, more cautious, and more strategic. That means some sectors are [...]

How Private Equity Really Works in New Zealand (and Why It’s Not Just for Big Corporates)

When people hear “private equity,” they often picture suits in glass towers doing billion-dollar deals in far-off places. It all sounds a bit Wall Street, a bit overkill for the average Kiwi business owner. But [...]